does wyoming charge sales tax on labor

State wide sales tax is 4. Groceries and prescription drugs are exempt from the Wyoming sales tax.

Sales Taxes In The United States Wikipedia

Services are subject to sales tax in a number of states.

. The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547. Municipal governments in Wyoming are also allowed to collect a local-option sales tax that ranges from. There are additional levels of sales tax at local jurisdictions too.

Wyoming sales tax rate is 4 and the maximum WY sales tax after local surtaxes is 7. The state sales tax rate in Wyoming is 4. Heres an example of what this scenario looks like.

Many states recently changed sales tax laws to apply taxes to labor. Iowa New Jersey and Virginia charge tax on labor. Additionally counties may charge up to an.

What states do not charge sales tax on labor. The Wyoming Department of Revenue has issued a news bulletin regarding the taxability of professional services. Remote and marketplace sellers.

The taxability of various transactions like services and shipping can vary from state to state as do policies on subjects such as whether excise taxes or installation fees included in the. Mary owns and manages a bookstore in Cheyenne Wyoming. Does minnesota charge sales tax on labor.

Since books are taxable in the state of Wyoming Mary. This is the same whether you live in Wyoming or not. The state-wide sales tax in Wyoming is 4.

The rules vary by state. Currently combined sales tax rates in. Sales Tax Laws By State Ultimate Guide For Business Owners All labor on both tangible.

Effective July 1 2018 labor and installation charges are included in the definition of gross receipts subject to Kentucky sales tax KRS 139010. Wyomings state-wide sales tax rate is 4 at the time of this articles writing but local taxes bring the effective rate up to 6 depending on the area. Does Wyoming charge sales tax on labor.

You can look up the local sales tax rate. For example lets say that you want to purchase a new car for 30000 you would use. Remote sellers and marketplace facilitators must collect sales tax from retail sales into Wyoming if they meet the.

Wyoming does not have a sales tax holiday. On top of the state sales tax there may be one or more local sales taxes as well as one or. The Excise Division is comprised of two functional sections.

As of 2017 5 states Alaska Delaware Montana New Hampshire and Oregon do not levy a statewide sales tax. Wyoming Use Tax and You. It is also the same if you will use Amazon FBA there.

The state of Wyoming charges a 4 sales tax. Wyoming first adopted a general state sales tax in 1935 and since that time the rate has risen to 4. No you do not pay sales tax on labor.

We advise you to check out the Wyoming. Wyoming has a destination-based sales tax system so you have to pay. Wyoming does not place a tax on retirement income.

In addition Local and optional taxes can be assessed. Wyoming has a statewide sales tax rate of 4 which has been in place since 1935. You can calculate the sales tax in Wyoming by multiplying the final purchase price by 04.

Pandemic May Have Worsened Trends Towards Sluggish U S Labor Supply Reuters

Faqs Wyoming Department Of Workforce Services

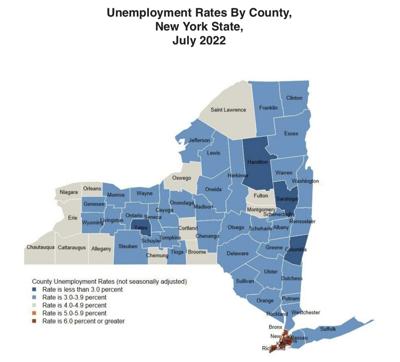

Genesee And Wyoming Unemployment Remains Among State S Lowest Local News Thelcn Com

Pandemic Brings Influx Of Remote Workers To Wyoming Ap News

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Which States Have The Lowest Tax Rates Seniorliving Org

How Do State And Local Sales Taxes Work Tax Policy Center

10 Best States For Lowest Taxes Moneygeek Com

General Sales Taxes And Gross Receipts Taxes Urban Institute

Ranking State And Local Sales Taxes Tax Foundation

Wyoming Sales Tax Tax Rate Guides Sales Tax Usa

Wyoming Sales Tax Rate Step By Step Business

Indian Relay Races To Fiestas Plenty To Do In Casper Over Labor Day Weekend Casper Wy Oil City News

Sales Tax Laws By State Ultimate Guide For Business Owners

Wyoming Sales Tax Handbook 2022

General Sales Taxes And Gross Receipts Taxes Urban Institute